Not so long ago, the company Robinhood was largely under the radar, but then things started to change for it once the company raised funding. Robinhood raised $110 million Series C at a $1.3 billion valuation during April 2017, which earned it a favorable status of a fintech unicorn.

A year later, Robinhood raised $363 million in Series D at a $5.6 billion valuation. Interestingly, both Series C and D funding rounds were led by DST Global, founded by Yuri Milner, a Russian investor.

The unprecedented success of its premium subscription model, “Gold,” on its margin trading platform combined with funding raised by the company has now prepared Robinhood to make a viable Wall Street debut.

Robinhood IPO in 2019: Everything You Need to Know

Robinhood announced its ambitious plan of becoming a publicly traded company back in September 2018 and is anticipated to hit the market in 2019.

As the fintech sector is going through an expansion and accelerated growth, Robinhood and similar companies that are rising to the surface of tech firms are becoming more interesting to investors.

Buy a Robinhood Stock in 3 Steps (For Accredited Investors Only)

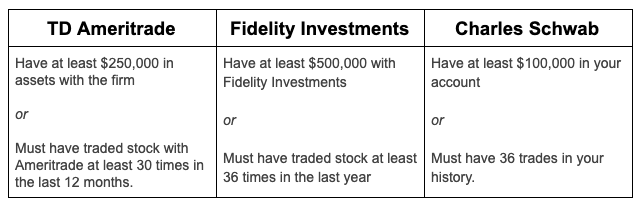

Big players in the space like Ameritrade, Fidelity, and Charles Schwab offer access to at least a few IPOs. Each of the above-mentioned firms has its own eligibility criteria that you need to fulfill to participate in an IPO. However, the one thing that is common in every case is that you must have an account with the respective firm to invest in an IPO via that firm.

Here’s how the process works:

Step 1: Proving the Eligibility

In addition to the above, there is also a prerequisite by the Financial Industry Regulatory Authority (FINRA) that needs to be fulfilled as well. Here is the complete list of rules that you need to abide by to trade in stocks.

Step 2: Request Shares

If you meet the requirements for participating in an IPO, the next step in the process is to request a certain number of shares in the IPO.

There is a good chance that you might not get all the shares that you requested to buy. To put it simply, your request is the maximum number of shares you’d want to buy assuming they are available.

Step 3: Place Your Order

By the day end of IPO “prices,” your broker or the firm that you chose in the first step will be notifying you if the offering is going forward. You will be given a deadline to confirm your order. It is only after you confirm the order that you will be able to know if you were able to buy any shares. In any case, you will not be able to buy any more shares than you have requested to buy in step 2, not even at the price higher than what you have offered to pay.

Finally, once the exchanges list the company, which is when the stock begins trading, you can find out if your shares have skyrocketed or collapsed.

What If You’re Not an Accredited Investor?

Because Robinhood is still a privately held company at this point, you cannot buy shares in the company currently if you are not an accredited investor.

However, if you believe in Robinhood’s future potential, the best way to invest is to open an account and invest in the blockchain market as a whole. Robinhood’s fortunes will likely rise with the overall blockchain market.

Related Articles:

- Biggest Blockchain Companies by Valuation in 2019

- What’s Up Next with Coinbase’s New Investment Arm

- How to Buy Bitcoin on Coinbase, Step by Step (With Photos)

For more information about blockchain companies to watch, subscribe to the Bitcoin Market Journal newsletter and have the latest blockchain news delivered to your inbox each week.