In my book BLOCKCHAIN FOR EVERYONE, I talk about an “aha moment” that came to me as I was listening to a lecture by Chris Burniske. If you don’t know that name, you will.

Burniske is one of the leading thinkers in the field of “Crypto Asset Valuation,” which simply means figuring out how these new digital investments should be priced. (He literally wrote the book on it.)

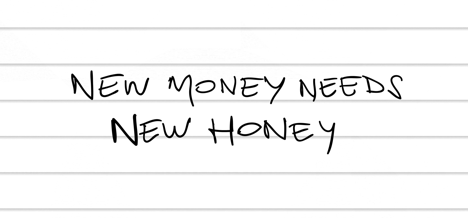

When I heard Burniske’s talk, the heavens opened up and a choir of angelic beings came down riding on golden minotaurs. (Your mileage may vary.) What he was saying made so much sense. For new assets like bitcoin, we need to find new valuation techniques. Or as I wrote in my notebook:

Now Burniske is back with a paper that outlines his latest thoughts on valuing bitcoin, altcoins, and other digital assets [download it here]. This is an incredibly important task, as otherwise we have no framework for knowing whether bitcoin (and everything else) is underpriced or overpriced.

Burniske has a brain the size of a planet, so here’s my shot at putting his paper into language that we humble Earthlings can understand.

The Two Buckets of Blockchain

Burniske breaks down the world of blockchain investments into two broad buckets: capital and commodities.

| Capital Coins | Commodity Coins | |

|---|---|---|

| Type | Productive | Non-Productive |

| Valuation | NPV (Net Present Value) of annual value flows | MV = PQ (where PQ = annual transaction volumes) |

| Ongoing stream of value? | Yes | No |

| Consensus mechanism | Proof of Stake | Proof of Work |

| Value comes primarily from | Transaction fees + value created | Cost of production + value created |

| Examples | Binance Coin, NEO, Decred | Bitcoin, Ethereum, Litecoin |

The key factor is the consensus mechanism. In Burniske’s planet-sized brain, Proof of Stake coins (like Decred) are generally capital, where Proof of Work coins (like bitcoin) are generally commodities. Let’s unpack this a bit.

Proof of Work blockchains use giant mining farms (i.e., huge computing clusters) that perform the calculations to make the blockchain system work: Bitcoin and Ethereum are the two most well-known examples. We might consider these commodities, akin to physical commodities like oil and gold. These blockchains use a tremendous amount of energy in order to produce, or “mine,” a single unit—just like commodities (it’s expensive to dig gold out of the ground).

Proof of Stake blockchains let owners of the altcoin “vote” on the blockchain system, according to how many coins they hold. Instead of consuming vast amounts of electricity, the system works by owners “staking,” or locking up, a certain number of coins: the idea is that those with the most skin in the game are the ones most interested in making the system work correctly. We might consider these coins more like capital, akin to putting your money to work by investing it in a company or a CD.

Here’s the common sense way of thinking about it:

- If an altcoin needs to be “locked up” in order to get maximum value, it’s a capital coin (just like you need to put traditional capital to work by investing it).

- If you can just hold the altcoin and get value without doing anything, it’s a commodity coin (just like you could hold value in a commodity like gold).

This is good news. It means that for “commodity coins” like bitcoin, we can estimate a “target price” using traditional economic models.

How Economists Calculate Bitcoin Price

The classic economic model is called the “Equation of Exchange,” which you may remember from your college econ class:

M x V = P x Q

where

| Traditional economics | Token economics | |

| M | Total money supply | Total money supply |

| V | Velocity of money (the number of times it “changes hands” in a year) | Velocity of the altcoin (the number of times it “changes hands” in a year) |

| P | Price of goods and services | P x Q = Annual transaction volume |

| Q | Quantity of goods and services |

For bitcoin, we know the annual transaction volume (about $3.3 trillion in 2018), and we can estimate the velocity (about 14, thanks to another excellent Chris Burniske post).

Our starting equation, courtesy of the great economists David Hume, John Stuart Mill, and Irving Fisher:

M x V = P x Q

To solve for M, we can rewrite this as:

M = PQ/V

Which gives us:

M = $3,300,000,000,000 / 14 = $235,714,285,714

In other words, $235 billion is the ideal amount of money needed to “service” all the bitcoin transactions in 2018. If we divide M by the number of bitcoins in circulation (about 17,680,850), we get:

$235,714,285,714 / 17,680,850 = $13,331.62

From there, let’s round it up to $13,333.33 to make it easier to remember. (That’s my contribution.)

There are plenty of assumptions here. You can argue that “real” bitcoin transactions were not $3.3 trillion in 2018; that plenty of this volume is people moving bitcoin in and out of exchanges; that the velocity of 14 is overstated or understated, etc.

That’s why I’ve also included a free bitcoin valuation spreadsheet, which you can use to plug in your own assumptions. Download it below.

Now we have a number. Bitcoin should currently be valued at $13,333.33. Why? Because economics.

Thanks for downloading our free bitcoin valuation spreadsheet. Download it here in Excel format.

P.S.: Sign up here to get more bitcoin intelligence and insight in our free weekly newsletter.