There are so many similarities between the 2020 and 2017 crypto market bull runs that it’s not funny. However, we prefer to focus on the differences.

It’s a question that seems to be on the minds of many investors lately, including the financial media.

In this article from CNBC, 5 out of the 5 analysts pointed to how much the world’s first and most established cryptocurrency has come in the last three years.

In short, the people who are now touting bitcoin are of a different variety. They’re not of the retail sector who are trying to protect themselves from currency devaluation by the 1%. They are the 1%.

This dynamic should come as no surprise, of course. It’s something I’ve personally been anticipating for a very long time, and it is now coming to full fruition.

What’s next?

As mentioned above, the price of bitcoin is now taking a breather. It’s come up from $10,000 to where it is now with relatively few pullbacks, and most people must be wondering if we have what it takes to break through to a new all-time high on this run, or if we need to see a bit of a pullback.

With that, the rest of the crypto market is taking a green flag. There’s obviously buying pressure in the market, but it seems as if some of the other established tokens have more room to run.

Today, many of the top 20 coins by market cap are reaching fresh highs, peaks last seen in 2018.

Yet, most are still a way off their all-time highest levels. So it would make sense that some of the traders out there (myself included) are trimming some BTC profits to redistribute into the alts.

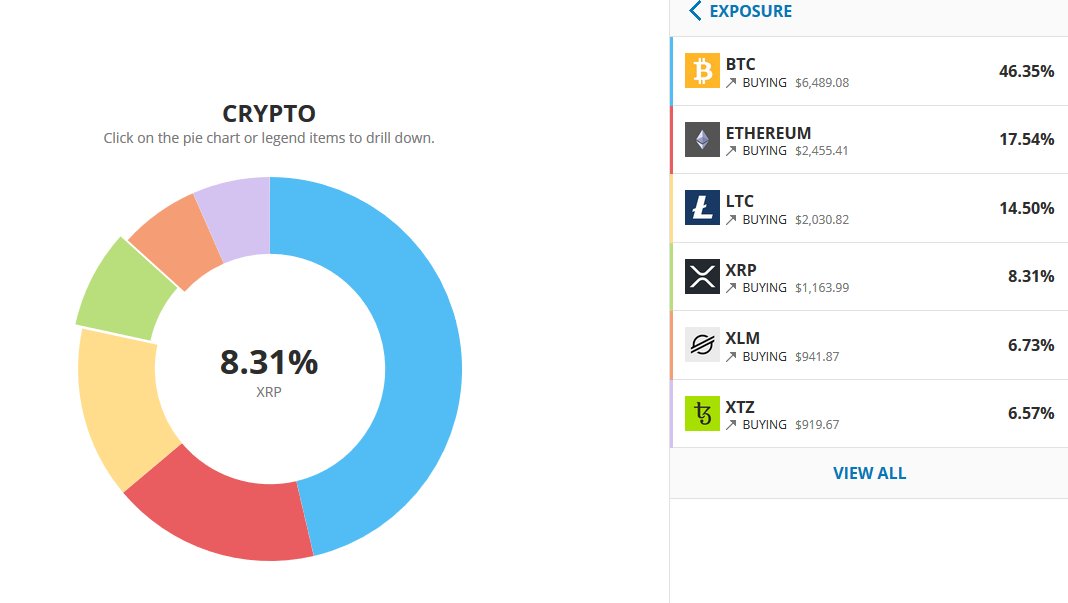

XRP and XLM are both on fire today and are now sitting prominently in my crypto-only high-risk public account at eToro.

See, if we follow the popular narrative portrayed above that it is in fact corporations and billionaires moving the market right now, then the established interbank tokens are actually positioned quite well to take advantage of this new wave of investments.

Still, bitcoin hasn’t really come down today. My watchlist currently shows it as -0.40% on the day, meaning that even though some of the industry veterans may be redistributing profits, momentum hasn’t shifted directions. Far from it.

The level of $19,000 is a logical place to test the psychological strength of this rally.

We can easily foresee a situation where it blasts through this level and then carries through for another $1,000 per coin, just as it did when it broke through the key price levels of $10,000, $12,000, $14,000 and then $16,500, as can be seen on this chart.

The beautiful thing is that should we reverse course, which is not desirable but still a possibility, all of those yellow lines on the chart now represent valid levels of support.

Another thing worth mentioning is that the all-time highest level on bitcoin (from 2017) is actually different depending on what chart you’re looking at.

Bitstamp seems to be the lowest, showing the high at $19,666, while several other brokers seem to be showing the all-time high as $19,891.

eToro has it the highest I’ve seen, all the way up at $20,155. So if and when we do see that new high will actually be quite subjective.

A stable outcome

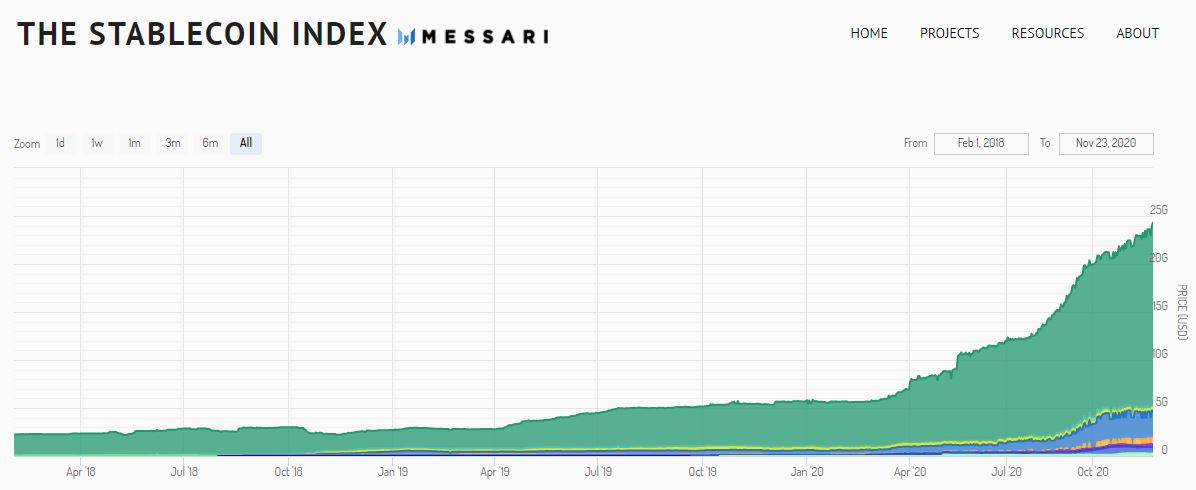

Of all the markets that have been skyrocketing lately, none has advanced as far as the stablecoins, whose combined market cap is now approaching $25 billion. Nineteen of these are from Tether (green).

The rise of stablecoins is arguably one of the fastest growing sections of the fastest growing industry on the planet right now.

Year-to-date, we’re looking at nearly 5X growth. The trouble is, it’s terribly difficult to invest in stablecoins. By definition, they don’t appreciate in value.

More often, people use stablecoins as a tool to replace fiat currency within a digital environment. All of the central bank digital currencies potentially fall under the label of stablecoins as well, so we’re more than likely to see these numbers accelerating from here.